A credit check is the most important part of the tenant screening process. It reveals whether your applicant has a history of making timely payments on things like utility bills, auto loans, or credit cards. More importantly, you’ll also know exactly how much debt they have to help you determine whether they can afford to pay rent. TenantAlert has access to the three major credit bureaus (TransUnion, Experian, and Equifax) and can set you up with the scoring model of your choice. The FICO model is the most common and is described below.

Sections of a Credit Report

Every prospective tenant will have their own unique credit report and it may or may not include these sections. For instance, some consumers may not have credit, or may have perfect credit and no collections or public records.

- Credit Profile Summary

The summary includes 17 key calculations that give you a true picture of a consumer’s debt, monthly obligations, and payment history. - Scorecards

TransUnion reports include a Rental Screening Score which is similar to a FICO score, but with a slightly different algorithm that weighs factors important for renting more heavily. - Personal Information

Displays alias names, current and previous addresses, date or birth, and social security number. - Employment Information

In some cases employment dates and company may appear. Be sure to call any employers not listed on the credit report to verify current employment. - Collections

A collection occurs when an account has too many late payments and gets turned over to a collection agency. You’ll find the name of the collection agency, amount and type of the collection, and whether it has been paid. - Public Records

This section shows tax liens, some monetary judgments, and bankruptcies. - Tradelines

Provides all lines of credit which may include credit cards, utility companies, auto loans, and personal loans. - Inquiries

A list of creditors or potential creditors who have accessed the applicant’s credit report.

Information Returned with a Credit Report:

- Name

- Address

- SSN

- Employment

- Trade lines

- Tax liens

- Bankruptcies

- Credit score

- Score average

- Collections

- Open accounts

- Closed accounts

- Total account balance

- Delinquent trade lines

- Late payments

- Account details

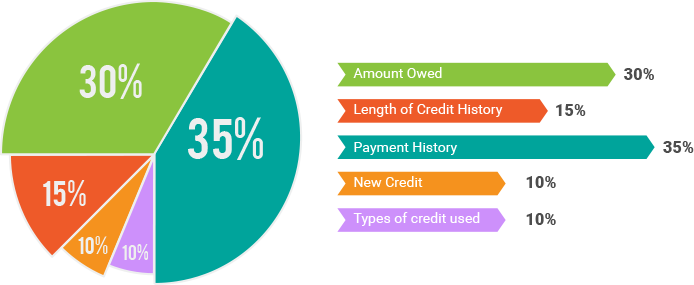

This chart, from myFICO.com, shows how the FICO score is calculated:

As a reminder:

- The important part of a FICO score is that it uses a mix of information to determine a credit worthiness score. The information available is going to vary from applicant to applicant and therefore will be different for each person.

- The FICO score provided will only be based on credit information. No additional information is considered for the score. As a responsible landlord you should be evaluating not only the FICO score but their eviction records, criminal history, and other information available such as TeleCheck and sex offender searches.